Case Studies

SAA Models

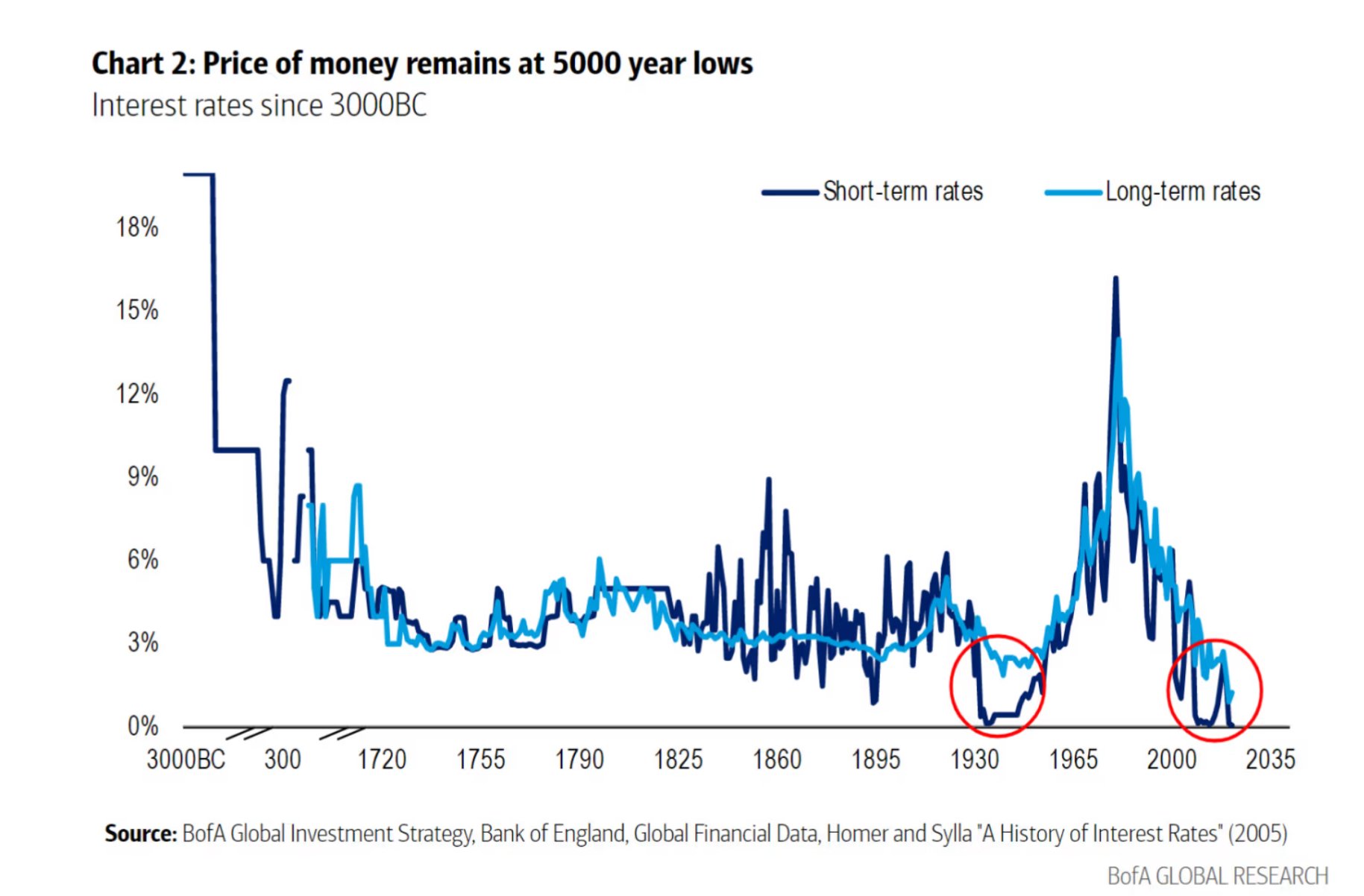

In 2021, an adviser was insistent on allocating 20% of a client’s portfolio into Fixed Interest. We resisted.

At a 5,000 year low for rates, it was not a difficult decision.

60/40 Models

“There have been 30 years of globalisation since the fall of the Berlin Wall; 20–30 years of remarkable Chinese growth; four decades of post-Volker interest rate declines; energy and food abundance; 13 years of extraordinary monetary policy (QE); a 30-year peace dividend, and a 30-year excess of global labour and capital mobility with ever declining costs of capital and lower tax rates.

These trends have provided a tailwind to investment returns, which can no longer be relied upon.

As the investing landscape changes, investing models are called into question. Modern Portfolio Theory relies on long established views of correlation and diversification. What if those no longer hold true? How will unconventional fiscal and monetary policy further challenge market expectations? How will the breakdown in globalisation and the disruption of capital flows, supply chains, energy markets and migration impact real economies and financial markets?”

-Future Fund, December 2022

We too are sceptical about relying on recent correlations in portfolio construction and have actively applied this in our thinking.