Statistics vary depending on criteria but there is simply no doubt that Mid-Size Businesses represent the engine room of Australia's economy.

Our most powerful sector employing more than 3.7 million Australians

According to Grant Thornton in a 2016 report, mid-size businesses with annual revenue of $10-250 million inject a combined annual turnover of $1.1 trillion into the Australia economy; contributing a further $241 billion through wages and salaries, employing more than 3.7 million Australians in the process.

Most Australian High Growth Firms are Mid-Size Businesses

It is very encouraging that in this year’s "Australian Innovation System Report" the Department of Industry, Innovation and Science has focused on the businesses that succeed the most, referred to as “high-growth firms” (HGFs). Well done!

"Australian HGFs make a disproportionate economic contribution compared to other firms. About 11,000 businesses, mostly Medium-Sized Businesses (20-199 staff, median turnover of $8 million) but also some larger corporates, were responsible for about 46% of new jobs between 2004/05 and 2011/12.

The growing policy interest in HGFs has given rise to a number of myths, including that HGFs are all high-tech firms or that HGFs are all small and young. In fact, international evidence suggests remarkable diversity in the HGF population ... HGFs can be found in every industry, size and age cohort.

Most growth firms are in established sectors, often providing well-established products in new or more efficient ways."

Meanwhile our Big Banks focus on Big Business

Sizing the market

Government data classifies Mid-Market businesses as "Medium-sized" where the business employs between 20 and 199 employees:

Here's a breakdown by industry:

Analysing all businesses by turnover shows that we have over 140,000 firms with turnover of $2 million and over:

Growth sectors

The highest growth sectors across all sizes of business are shown in the following chart. Services dominate.

How durable are our businesses?

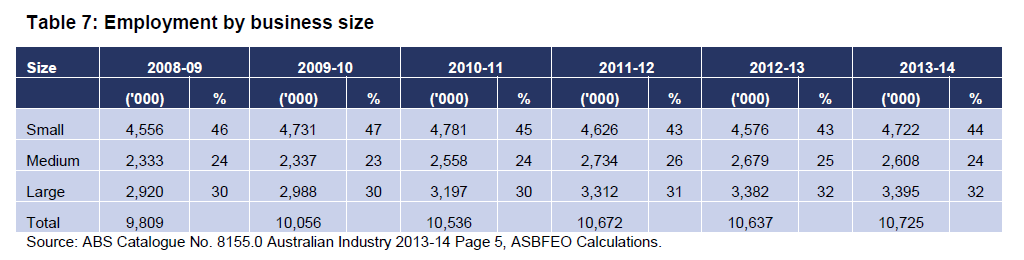

As summed up by the Small Business Ombudsman (ASBFEO), Kate Carnell, our business environment is dynamic but unlike our smaller businesses, Mid-Market businesses are generally stable with a strong pipeline of growing small businesses becoming Mid-Market businesses:

"The size of a business is an important determinant of business longevity. The small business sector is very volatile, with non-employing small businesses having the lowest survival rate of all businesses in Australia. Paradoxically, this ongoing creation and destruction of small businesses is an explanation for the adaptability and resilience of the small business sector. It enables new business ventures to quickly spring up to exploit new opportunities and promptly exit declining industries.

The ‘born-global’ phenomenon is seeing greater numbers of small businesses entering export markets at an early stage of their development. In 2013-14, 44 per cent of goods-exporting firms were small businesses. However, they are generally niche players, accounting for a very small percentage (about 0.5 per cent) of the total value of Australian exports.

Women are becoming increasingly significant in small business. In 1991, 31 per cent of small businesses owners/managers were women. By 2015 this figure had risen to 34 per cent.

A healthy small business sector is a prerequisite for a growing economy with high employment opportunities. In a very real sense, small business counts."